Last updated on January 10, 2026

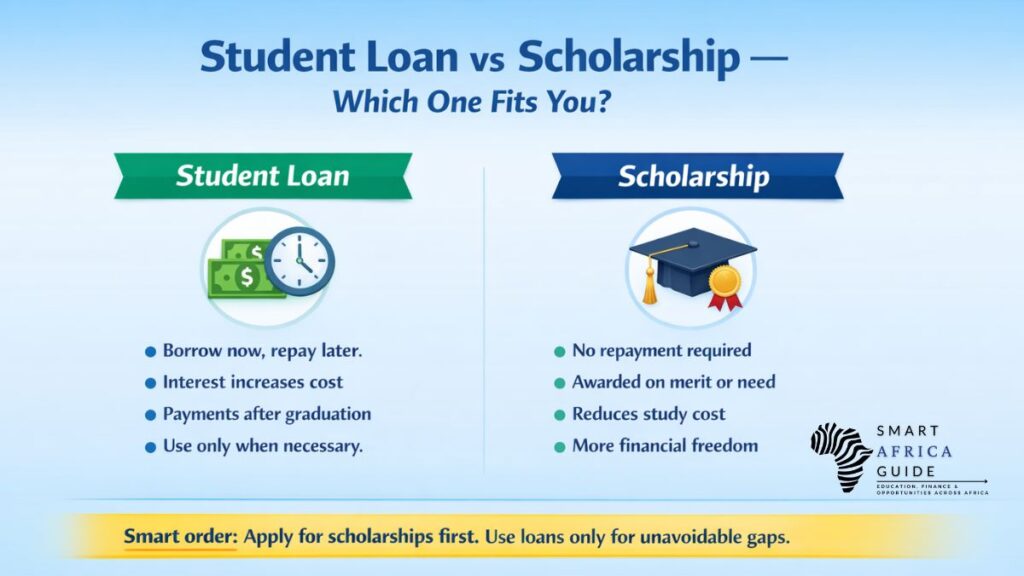

How is a student loan different from a scholarship? Here is the simple truth first: A scholarship gives you money for your studies that you do not need to pay back, while a student loan helps you study now but must be repaid later with interest. That single difference may look simple — yet it can shape your finances, your choices after graduation, and even the kind of life you live later.

If you are unsure which path is right for you, this article will help you think clearly, compare realistically, and choose the option between student loan vs scholarship so you can make the right decision for your future.

The foundation of every state is the education of its youth.

Quick Glance

- A scholarship does not need to be repaid.

- A student loan must be repaid, usually with interest.

- Scholarships are awarded based on merit, need, or specific criteria.

- Loans are easier to get, but they create debt after graduation.

Table of Contents

Student Loan vs Scholarship

Many students only think about money right now, but understanding student loan vs scholarship helps you see how each decision affects your future. Here’s a simple side-by-side view to see the differences at a glance:

| Feature | Student Loan | Scholarship |

| Repayment required | Yes – always, with interest | No – you do not repay |

| Long-term financial effect | Monthly payments for years | No debt burden |

| Based on | Enrollment, financial eligibility, ability to repay | Merit, need, talent, or specific criteria |

| Source | Banks, lenders, governments | Universities, NGOs, companies, governments |

| Risk level | High – debt increases if unpaid | Low – only eligibility rules |

| Emotional impact | Stress, obligation, limited flexibility | Relief, motivation, financial freedom |

| Best used for | Filling unavoidable funding gaps | Reducing or removing cost completely |

When comparing student loan vs scholarship, the biggest difference is whether you will need to repay the money later.

What Is a Student Loan?

A student loan is money specifically borrowed to pay for education. You receive money now. You repay it later, usually with interest.

Student loans commonly cover:

- Tuition fees

- Admission and registration charges

- Textbooks and lab materials

- Accommodation and meals

- Laptops, equipment, transport

They may come from:

- Government programs

- Banks

- Financial institutions

- Specialized student lenders

In most cases, the institution gets paid directly.

The quiet truth is that interest doesn’t wait politely. In many loans, interest:

- Starts adding up immediately

- Grows month after month

- Increases the total far beyond what you originally borrowed

That’s why student loans must be handled carefully, not emotionally.

Types of Student Loans in Simple Terms

Not all student loans work the same way. Some are designed to help, others can feel expensive if you are not careful.

- Government-backed loans are usually the safest starting point. They tend to have lower interest rates, more flexible repayment plans, and sometimes options to pause payments during difficult times. These exist to make education possible, not impossible.

- Private or bank loans come from financial institutions. They can fill gaps when other aid is not enough, but they often have higher interest and stricter rules. The bank decides the rate, and missing payments can become costly very quickly.

- Parent or co-signed loans involve someone else sharing responsibility. A parent or trusted adult signs with you, promising to repay if you cannot. This can help you qualify, but it also places pressure on relationships if repayment becomes difficult.

Before choosing any loan, slow down, compare options, and think about future payments, not just today’s fees.

How Student Loans Work

Here’s what usually happens step by step.

Application

You submit details about:

- Where you are studying

- How much does the program cost?

- Your income or your family’s income

- Financial history

- Identification documents

Loan approval

If approved, the lender shares:

- Your loan amount

- Interest rate

- Repayment start date

- Estimated total you will pay over time

This is where most students skim.

They sign. They move on. They hope for the best.

But those few pages are more important than most assignments.

Money disbursed

Funds go to:

- Your university, or

- Your account (depending on rules)

Interest begins

Interest usually grows during:

- Your study period

- Grace period

- Repayment years

Repayment starts

This begins:

- After graduation, or

- If you leave school, or

- If you drop below the required enrollment

Repayments include:

- Original loan

- Interest

- Sometimes fees or penalties if late

That’s when reality becomes real. Rent. Groceries. Transport. Life.

And now, monthly student loan payments.

Why Students Still Choose Student Loans?

Student loans exist for a reason. They help when:

- Savings aren’t enough

- The family cannot support the fees

- Scholarships do not work out

- Stopping education creates bigger losses later

A well-planned loan is not a failure. It is simply a temporary bridge. The key lies in planning and not denial.

What Is a Scholarship?

A scholarship is financial support awarded for education that you do not repay. No interest. No repayment bills. No long-term debt tied to your name.

Types of Scholarships

Scholarships come in many forms, and knowing the main categories helps you focus your effort where you actually stand a chance.

Merit-based scholarships

These are awarded for achievement. Good grades, strong test scores, leadership roles, sports, arts, or community work can all count. They reward effort and performance, not income.

Need-based scholarships

These support students whose families cannot reasonably afford the full cost of education. Decisions usually consider income, expenses, and overall financial situation.

Field-specific scholarships

Some awards are created for students entering particular careers — like engineering, nursing, teaching, IT, or agriculture. Sponsors want to encourage more talent in those areas.

Student-specific scholarships

These support students from certain backgrounds or with specific circumstances such as first-generation students, single parents, women in STEM, rural students, or underrepresented communities.

Activity and talent scholarships

Athletes, musicians, debaters, writers, and creative students may also qualify based on skill and commitment.

The key point: there is almost always a scholarship that fits someone like you — if you search intentionally instead of randomly.

How Scholarships Work?

Scholarships follow a simple but structured process. Understanding it makes applying for scholarships far less stressful.

You apply

You fill out forms and submit whatever is requested: grades, scholarship essays, financial details (if needed), recommendation letters, portfolios, or certificates. Everything must match the eligibility rules.

Applications are reviewed

A committee evaluates candidates and shortlists those who best match what the scholarship is trying to support — effort, promise, need, or impact.

Selections are announced

If selected, you receive an official award letter explaining how much you get, what it covers, and any conditions you must follow.

Money is disbursed

Most of the time the money goes straight to the institution to reduce your fees. Sometimes a portion is paid to you for books, materials, or approved living costs.

Conditions may apply

Some scholarships renew each year — but only if you maintain grades, stay in your program, and follow deadlines. Others are one-time awards.

Scholarships feel simple on the outside, but success usually comes from being organized, reading instructions carefully, and applying to several programs — not just one.

Live as if you were to die tomorrow. Learn as if you were to live forever

Why Students Still Choose Scholarships?

Students continue to chase scholarships for a reason, they change the way education feels.

They reduce financial pressure

You study without constantly worrying about repayment later. That alone can shape your decisions after graduation.

They protect your future income

Graduating without heavy debt means you have more freedom to choose internships, first jobs, or career paths that actually build experience, not just quick cash.

They create opportunity

Scholarships often make better programs or better universities possible — choices that might otherwise be out of reach.

They build confidence and credibility

Winning a scholarship shows commitment and discipline. Many students use that recognition to stand out on resumes and applications.

They let students focus on learning

Less financial stress means more time for studying, projects, networking, or activities that genuinely help later.

For many students, scholarships are not about “free money.” They are about starting adult life with fewer financial chains attached.

Why Students Struggle With Selection Between Student Loan & Scholarship

Parents often feel confused about student loan vs scholarship, especially when banks and schools explain things differently. Also, most of them are under pressure. Deadlines. Expectations. Fees. Family conversations. Forms. Emails. And somewhere in the chaos, financial choices get rushed. That’s when painful situations happen later.

Students discover:

- “My repayments are higher than my salary.”

- “Interest increased more than I expected.”

- “I chose a job only because I needed to pay off debt.”

- “If I had tried harder for scholarships, I wouldn’t be stuck now.”

At the same time, many students also believe:

“Scholarships are impossible. Only geniuses get them.”

This is rarely true.

Scholarships exist for:

- Average students

- Hardworking students in different grades

- Students with leadership qualities

- Students with financial struggles

- Students from specific backgrounds

- Students entering specific careers

The problem is not eligibility. The problem is awareness and strategy. So instead of “loans bad, scholarships good,” the real question becomes:

“Which funding choice allows me to build my future with the least pressure?”

A clear student loan vs scholarship comparison can stop you from taking debt you do not actually need.

Some students also mix up bursaries with scholarships. Our detailed guide on bursary vs scholarship explains how they are different and who actually qualifies.

Student Loans vs Scholarships: Which One Fits Your Future?

A Simple Thinking Framework to Help You Choose Easily

Instead of asking:

“Which option sounds easiest right now?”

Ask:

“Which option gives me the most freedom five years after graduation?”

Walk through this:

- Did I apply widely for scholarships?

- Did I honestly research eligibility?

- Did I consider less expensive education options?

- If I take a loan, can I truly repay comfortably?

- What happens if my income is lower than expected?

Before applying anywhere, take a moment to look at student loan vs scholarship side by side so you know exactly what you are saying yes to.

Don’t Make These Mistakes When Choosing

Here are mistakes students repeat year after year when choosing between student loan vs scholarship:

- Taking the maximum loan available “just in case”

- Ignoring interest rates and repayment terms

- Applying for scholarships only once

- Assuming someone else will figure finances out

- Treating loans like “free money for now”

- Not asking questions because it feels embarrassing

Do this instead:

- Talk to financial aid advisors

- Compare loan terms line by line

- Apply for several scholarships regularly

- Borrow only what is absolutely necessary

- Calculate repayment before signing anything

A few careful decisions today prevent many financial headaches later. Teachers and counselors often encourage learners to think about student loan vs scholarship before committing to any financial paperwork.

FAQs

Does taking a student loan always mean debt will be stressful later?

Not always, but it can be if you borrow more than you realistically can repay.

Before accepting a loan, calculate:

Expected starting salary in your field

Monthly repayment estimate

How long will the repayment last?

If repayments take most of your income, the loan becomes restrictive instead of helpful.

Are scholarships only for students with perfect grades?

No. Grades help, but they are not the only path. Students lose scholarships more often because they never apply, not because they are unqualified.

Can I use both a scholarship and a student loan together?

Yes. Many students combine them. The smart way to think about it:

Use scholarships to reduce costs first.

Then use the smallest loan needed to cover what remains.

This keeps repayments manageable after graduation.

If I get a scholarship once, do I keep it automatically every year?

Not automatically. Most scholarships require you to:

Maintain a certain GPA

Stay enrolled in the required program.

Follow academic or conduct rules

Submit renewal documents on time.

Missing these can result in losing the award, sometimes permanently.

What happens if I cannot repay my student loan on time?

Late payments can lead to:

Added fees and interest

Damaged credit score

Difficulty getting future loans or housing

Possible legal or collection action

If you’re struggling, contact the lender early. Many offer deferment, restructuring, or income-based repayment. Ignoring the problem always makes it worse.

How can I reduce how much I need to borrow?

You can lower borrowing by:

Applying for multiple scholarships, not just one

Considering more affordable schools or programs

Working part-time where possible

Avoiding unnecessary living expenses tied to loan money

Every small reduction today removes future interest.

Which option is safer for long-term financial health?

Scholarships are safer because they don’t create debt. Loans can still be reasonable, but only when:

You understand repayment clearly.

The degree meaningfully increases earning potential

You borrow only what you need, not what you’re offered

A simple guiding rule:

If the loan amount feels heavy before signing, it will feel heavier later.

Final Thoughts

Student loan vs scholarship is not just about paying for school. It is about protecting:

- Your future income

- Your mental health

- Your freedom to choose opportunities

Remember the smart sequence:

- Apply widely for scholarships

- Reduce study costs where possible

- Use student loans only to fill unavoidable gaps, and borrow cautiously

Education should open doors. Debt should not close them. There is no single “right” answer for everyone. The right choice is the one that keeps your future flexible and manageable. When you understand student loan vs scholarship, it becomes much easier to choose calmly and avoid regret later.

Varsha Asrani is a lecturer and education writer with experience as Visiting Faculty at AUPP and ATMC College, and as a Lecturer with TalentEdge and UpGrad. She is the Founder of the Asrani Institute of Education and Counselling. Varsha specializes in scholarships, e-learning, and career guidance for African students and professionals, and regularly visits Africa to gather first-hand insights that shape her research and articles.